Major Events in Banking

1946

Source: Artnisen

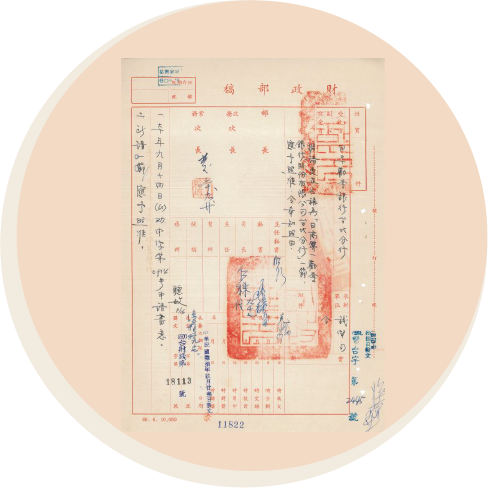

Land Bank of Taiwan

Source: History Room of the Ministry of Finance, R.O.C

1959

Source: History Room of the Financial Supervisory Commission

Taiwan's First Credit Card issued by CTBC Bank

Source: Public Relations & Public Welfare Division of CTBC Bank

1974

1976

Chung Hsing Bills Finance Corporation was the first monetary intermediary institution in Taiwan. It facilitated money market revitalization, promoted economic development, and assisted in industrial improvement.

Chung Hsing Bills Finance Building

Source: Taiwan Cultural Memory Bank

1977

Bank of Taiwan introduced the first ATM in Taiwan, a milestone in the digitalization of Taiwan’s financial industry.

Opening Ceremony of The Export-Import Bank of the Republic of China

Source: History Room of the Ministry of Finance, R.O.C

1979

The Export-Import Bank of the Republic of China (Eximbank) is Taiwan’s only state-owned export credit bank. It provides medium- and long-term export-import financing, guarantee and export insurance services. Eximbank supports Taiwan’s national economic and trade policy, assists vendors to enter export markets, and shares the risks of trade, promoting domestic industrial upgrade and international economic cooperation.

1983

The International Commercial Bank of China (the predecessor of Mega Bank) established Taiwan’s first offshore banking unit (OBU). Subsequently, many other banks also established OBUs, helping accelerate the development of international finance business in Taiwan.

1984

The National Debit Card Center, formed by seven financial institutions, officially issued National Debit Cards. The 1988 card was renamed as the National Credit Card (with revolving credit), and initiated cooperation with international credit card operators, helping develop Taiwan’s credit card market.

Unit Debit Card

Source: History Room of the Financial Supervisory Commission

The first ATM in Taiwan

Source: History Room of the Ministry of Finance, R.O.C

1987

Taiwan Bank introduced the first ATM in Taiwan in 1977. In 1987, ATMs started to offer cash withdrawal and balance inquiry services, greatly improving the convenience of finance.

1992

In 1992, ATMs started to offer an interbank transfer service, allowing people can make transfers at any ATM.

1999

2001

Source: Fubon Group 60th Anniversary Commemorative Magazine

2015

2017

2020